Search

What issues should I consider with my employer benefits?

What issues should I consider with my employer benefits? Electing benefits can be a daunting task, and it’s difficult to know which benefit

Jun 8, 2022

Am I At Risk Of Having My Identity Stolen Or Being A Victim Of Fraud?

Am I At Risk Of Having My Identity Stolen Or Being A Victim Of Fraud? cyber threats, common scams, unlawful activity

Jun 7, 2022

What issues should I consider for my aging parent?

What issues should I consider for my aging parent? Becoming a caregiver for aging parents can be a drain emotionally and can carry financial

Jun 3, 2022

Should I Establish A SEP IRA Or A SIMPLE IRA Plan For My Small Business?

Our business owner clients may be searching for retirement plan options that benefit their employees and themselves, without incurring...

May 27, 2022

What Issues Should I Consider If I Lose my Job?

Clients sometimes find themselves in the position of losing their job. In today’s economic uncertainty, business closures and layoffs are...

May 26, 2022

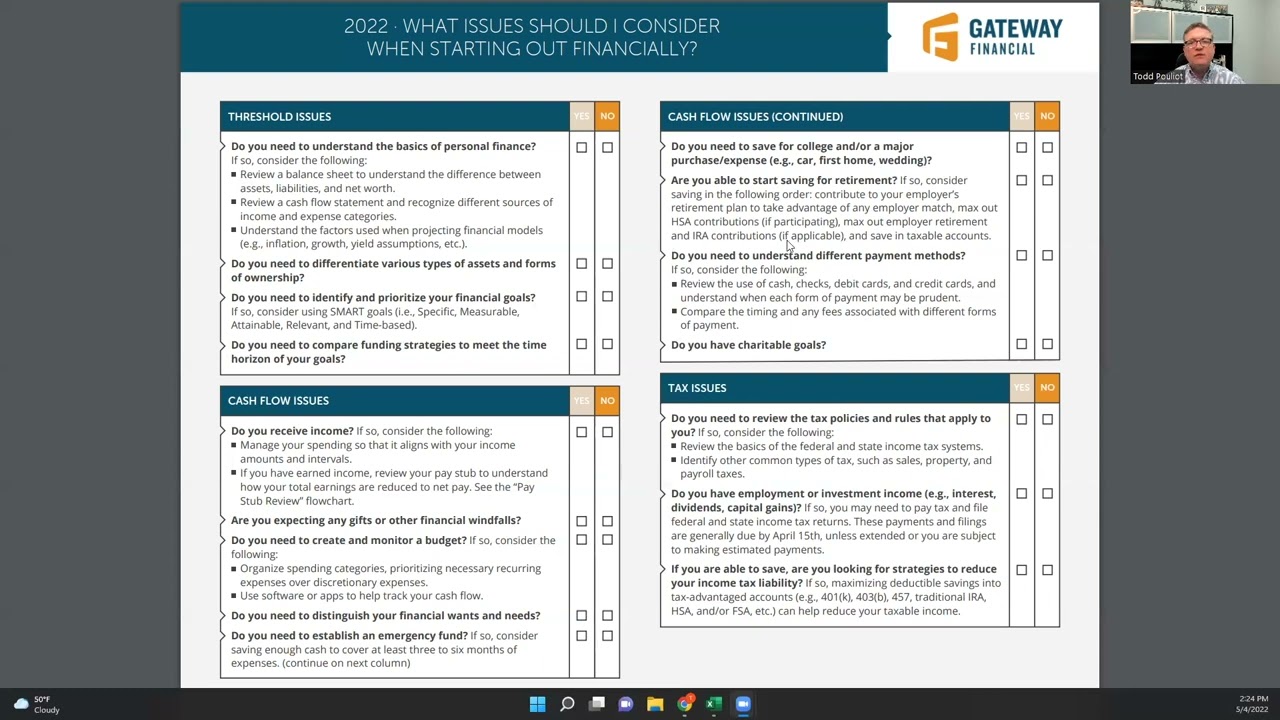

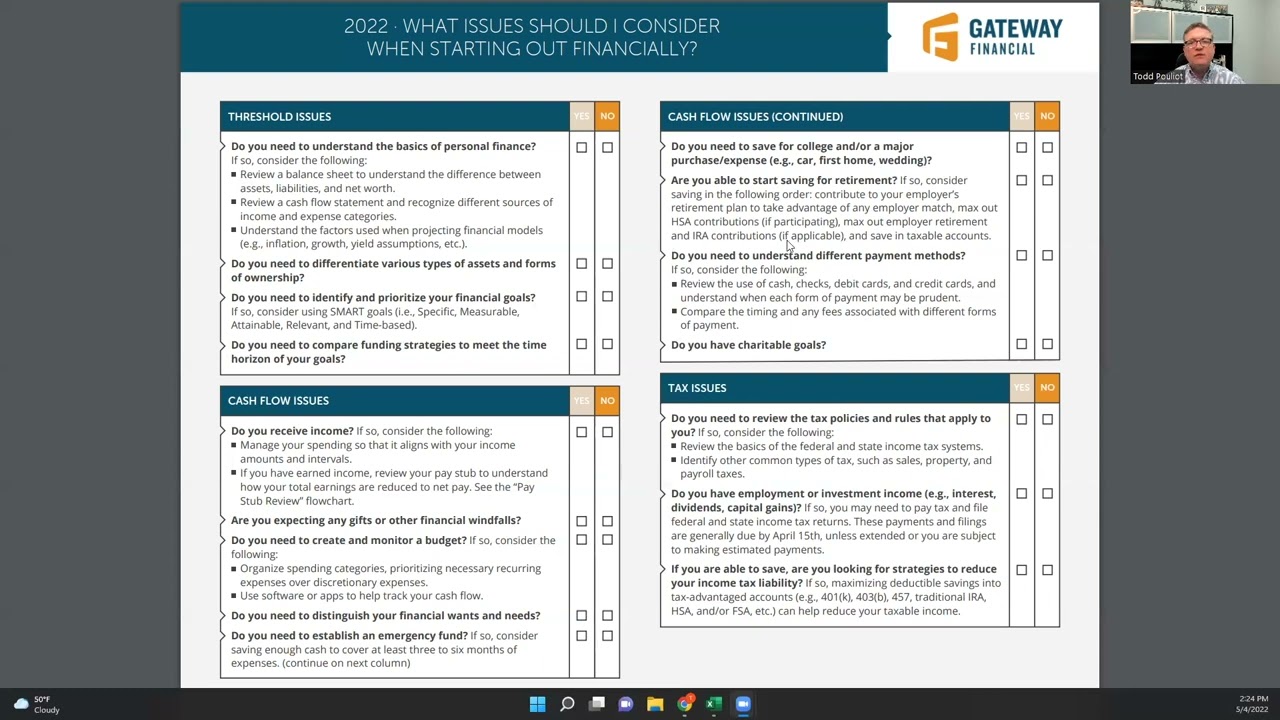

What Issues Should I Consider When Starting Out Financially?

What Issues Should I Consider When Starting Out Financially? Financial literacy is fundamental to financial independence and prudence.

May 22, 2022

Master List of Goals

Master List of Financial Planning Goals. Goal setting is fundamental to sound financial planning. Whether we are meeting with new or long-te

May 11, 2022

Am I At Risk Of Having My Identity Stolen Or Being A Victim Of Fraud?

Am I At Risk Of Having My Identity Stolen Or Being A Victim Of Fraud? There has been an increase in fraudulent and criminal activity.

May 9, 2022

What Issues Should I Consider If My Spouse Passed Away?

What Issues Should I Consider If My Spouse Passed Away? 29 of the most important planning issues

May 6, 2022

.png)