Search

Will The Deductibility Of My Retirement Plan Contributions Be Impacted By The QBI Rules?

The QBI (Qualified Business Income) deduction rules are complicated. One of the newest planning issues to consider deals with a possible QBI

Mar 14, 2022

Will My Roth IRA Conversion Be Penalty Free?

Converting a portion of an IRA to a Roth IRA is a complex process that involves many moving parts.

Mar 10, 2022

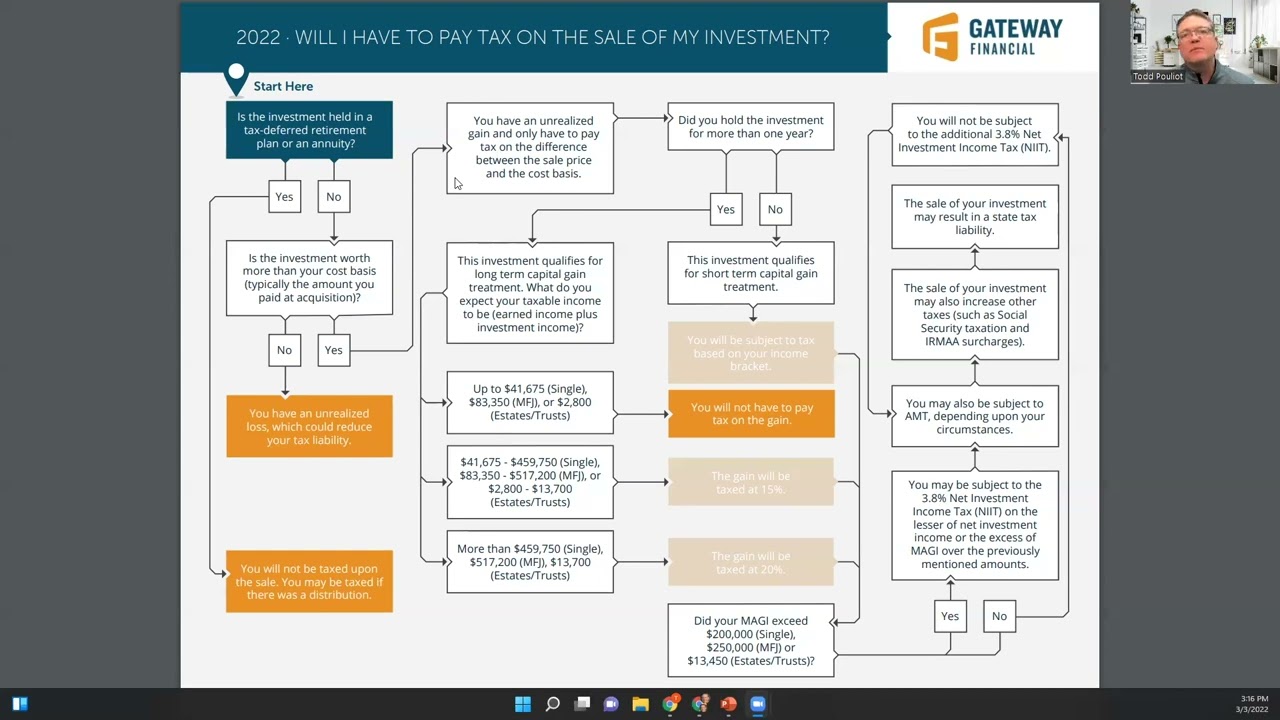

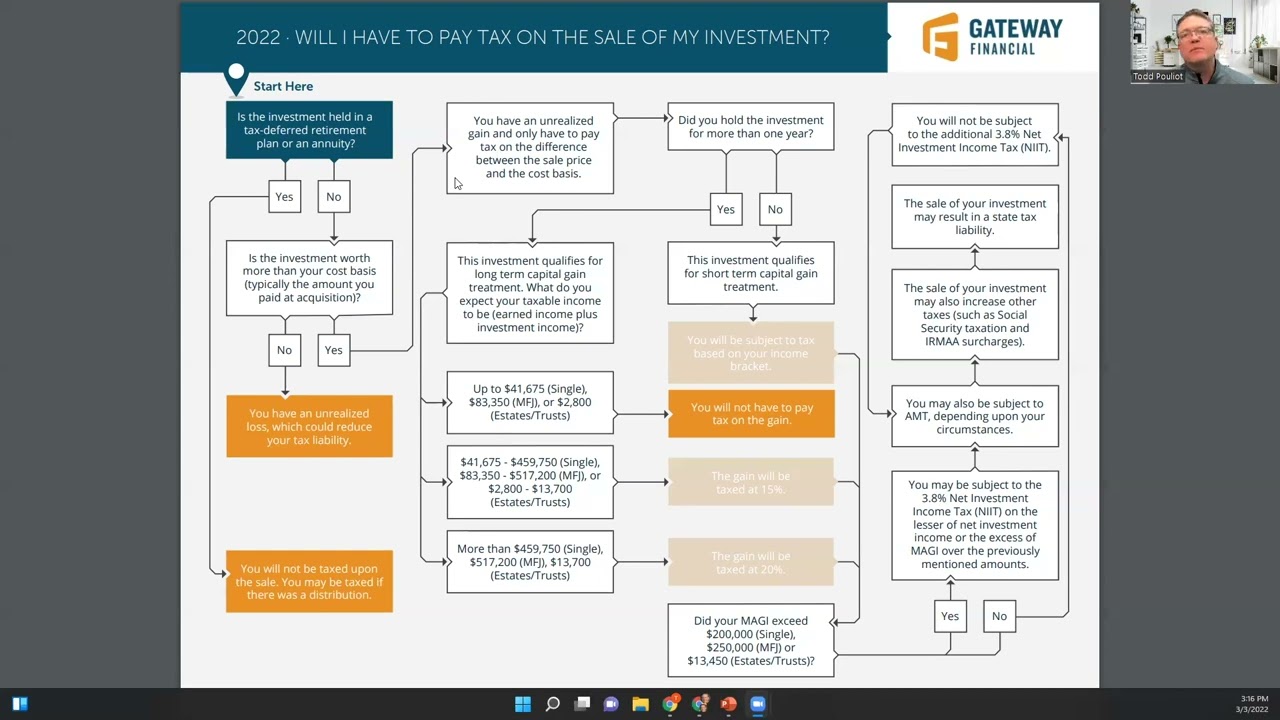

Will I have to pay tax on the sale of my investment?

Determining the tax impact of selling an investment can sometimes be complicated. There are several questions...

Mar 8, 2022

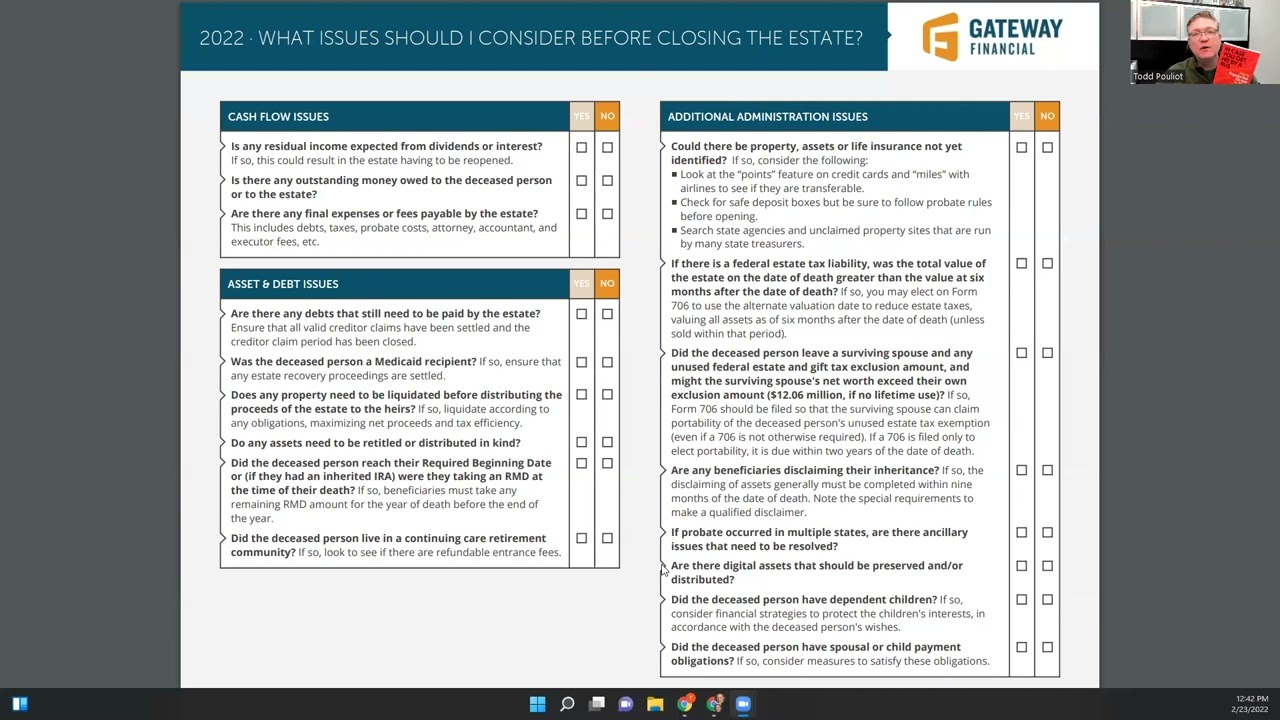

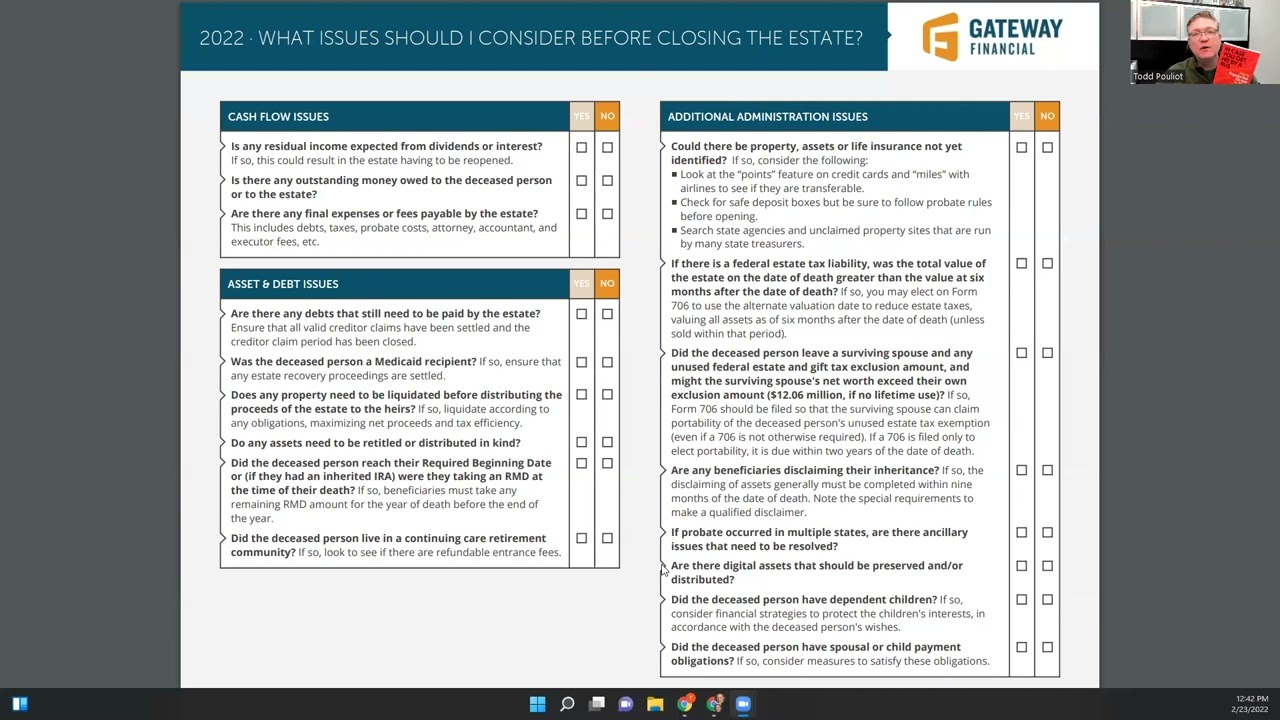

What Issues Should I Consider Before Closing The Estate?

This checklist covers 25 of the most important planning issues to identify and consider before a client closes an estate for a loved one.

Feb 25, 2022

Should I Roll Over My Dormant Traditional 401k

Common IRA and 401(k) features and differences Net Unrealized Appreciation options Age-based distribution options Taxes and penalties in...

Feb 22, 2022

What Will Have The Least Tax Impact Harvesting Capital Gains Or Roth Conversions?

Clients often have outsized positions due to appreciation and large pre-tax retirement accounts. They may be looking to reduce risk...

Feb 15, 2022

Pay Stub Review

A pay stub is a valuable source of information when building financial models and evaluating cash flow.

Feb 14, 2022

What issues should I consider when reviewing my tax return?

Reviewing a tax return can always be an informative exercise to ensure you understand all sources of income and tax liabilities

Feb 10, 2022

What is Tax Planning?

WHAT IS TAX PLANNING?

Tax planning refers to our review of your tax return to identify potential planning opportunities.

Feb 2, 2022

.png)