Search

What Issues Should I Consider When Reviewing My Health And Life Insurance Policies?

A client’s life and health insurance policies are a key part of their overall financial plan. It’s important to review these policies...

Feb 7, 2022

What is Tax Planning?

WHAT IS TAX PLANNING?

Tax planning refers to our review of your tax return to identify potential planning opportunities.

Feb 2, 2022

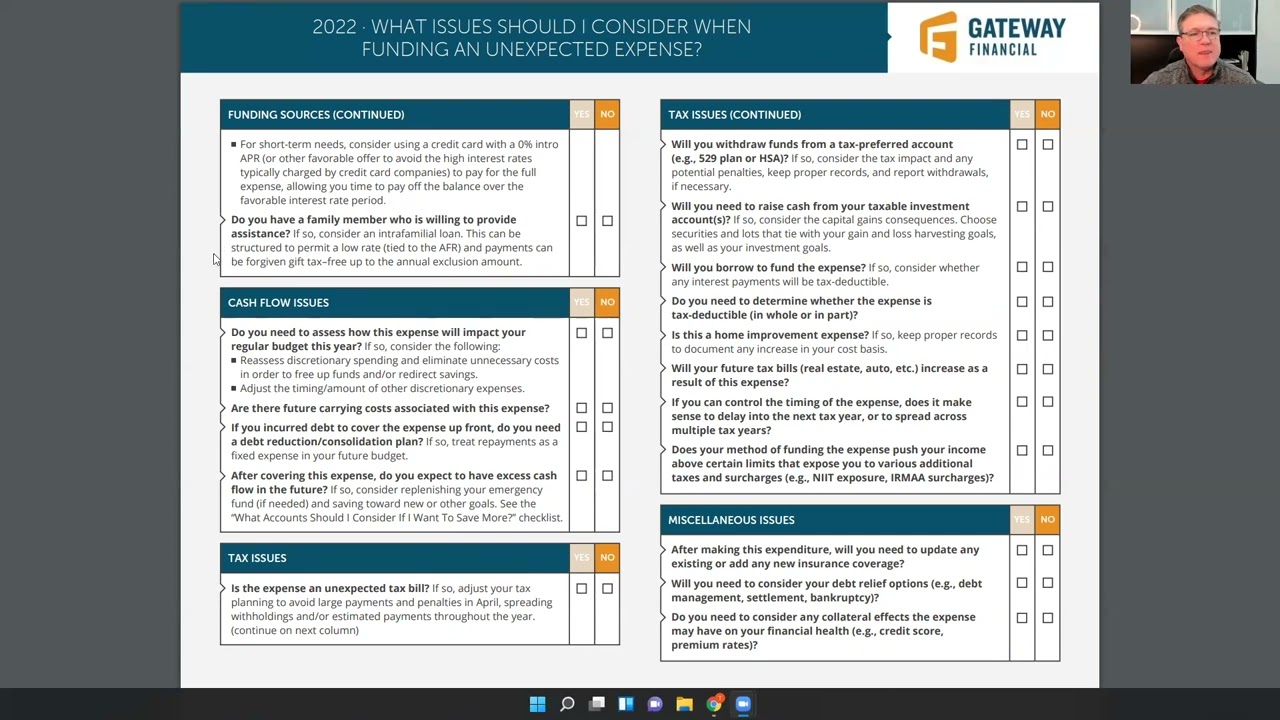

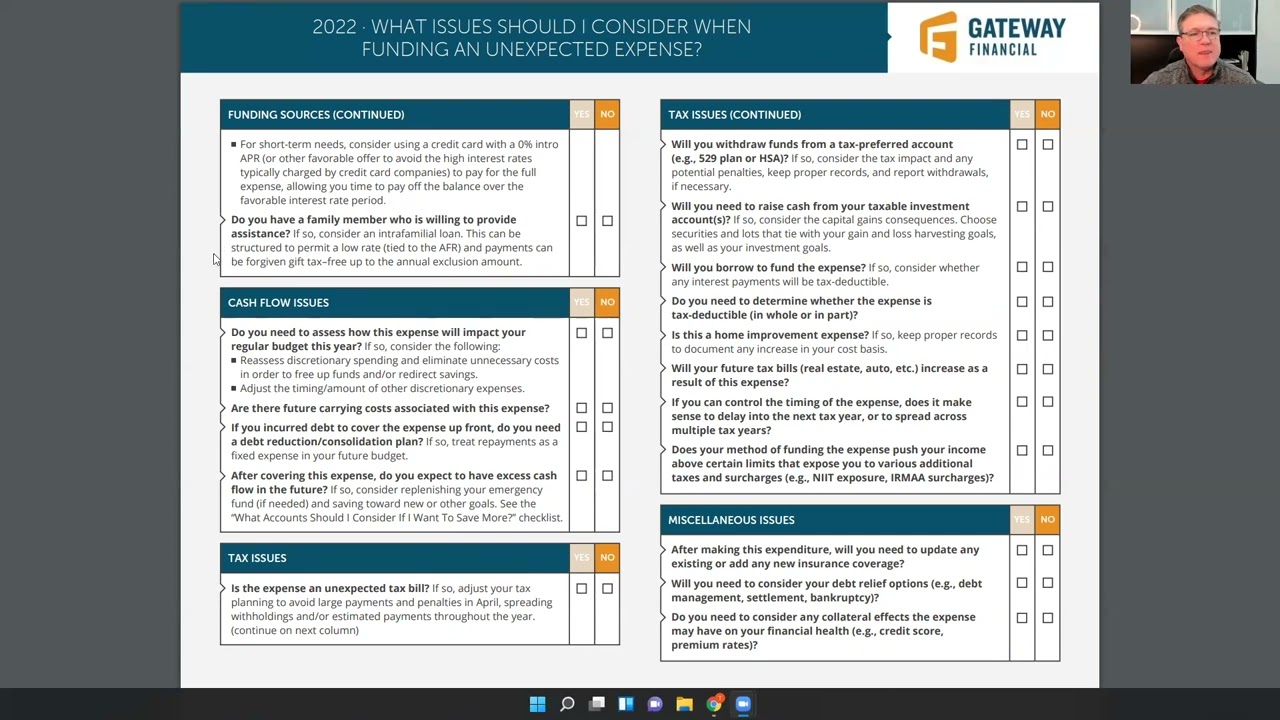

What issues should I consider when funding an unexpected expense?

This checklist covers the key issues to consider when a client must fund an unexpected expense. It addresses: Payment strategies Funding...

Feb 1, 2022

What issues should I consider before I update my Estate Plan?

This checklist covers 19 of the most important planning issues to identify and consider for a client before updating their estate plan.

Jan 31, 2022

What issues should I consider if I get a promotion or raise at work?

When a client receives a promotion or a raise at work, this event can come with a number of changes that might impact their financial...

Jan 28, 2022

Employee Stock Purchase Plans (ESPP)

Employee Stock Purchase Plans can be an important benefit for our clients. These programs can allow the purchase of employer stock.

Jan 27, 2022

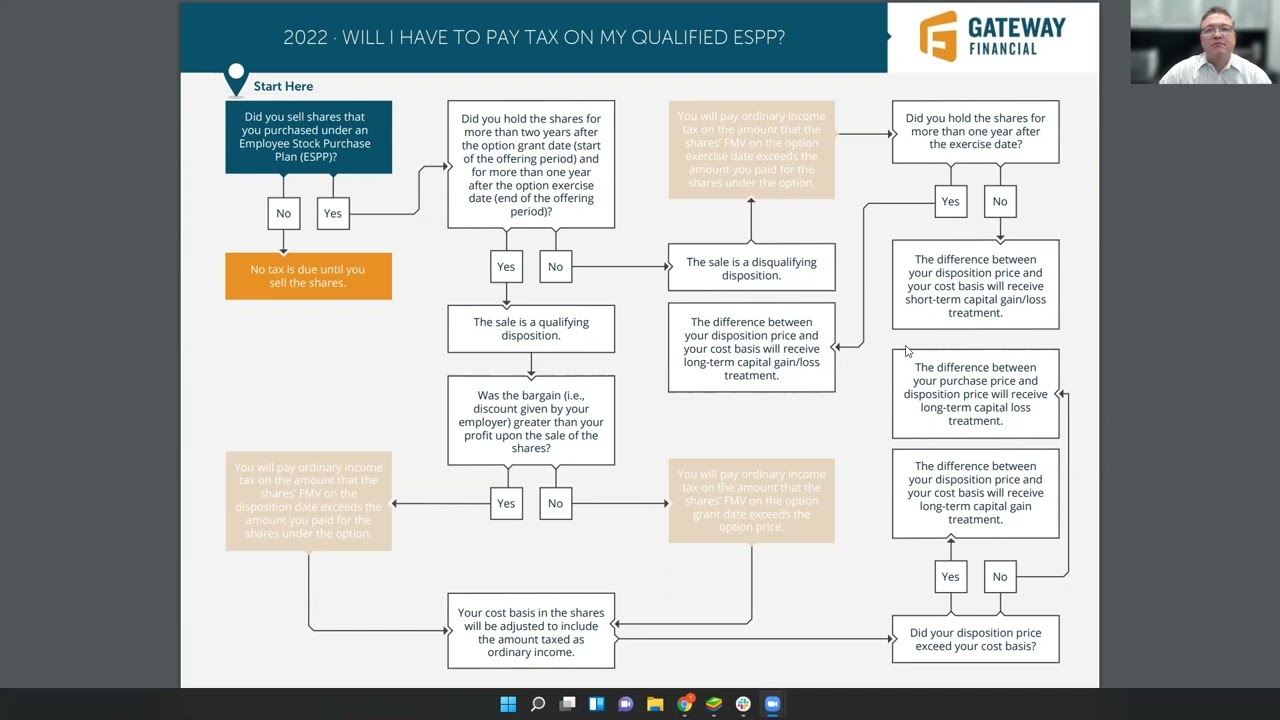

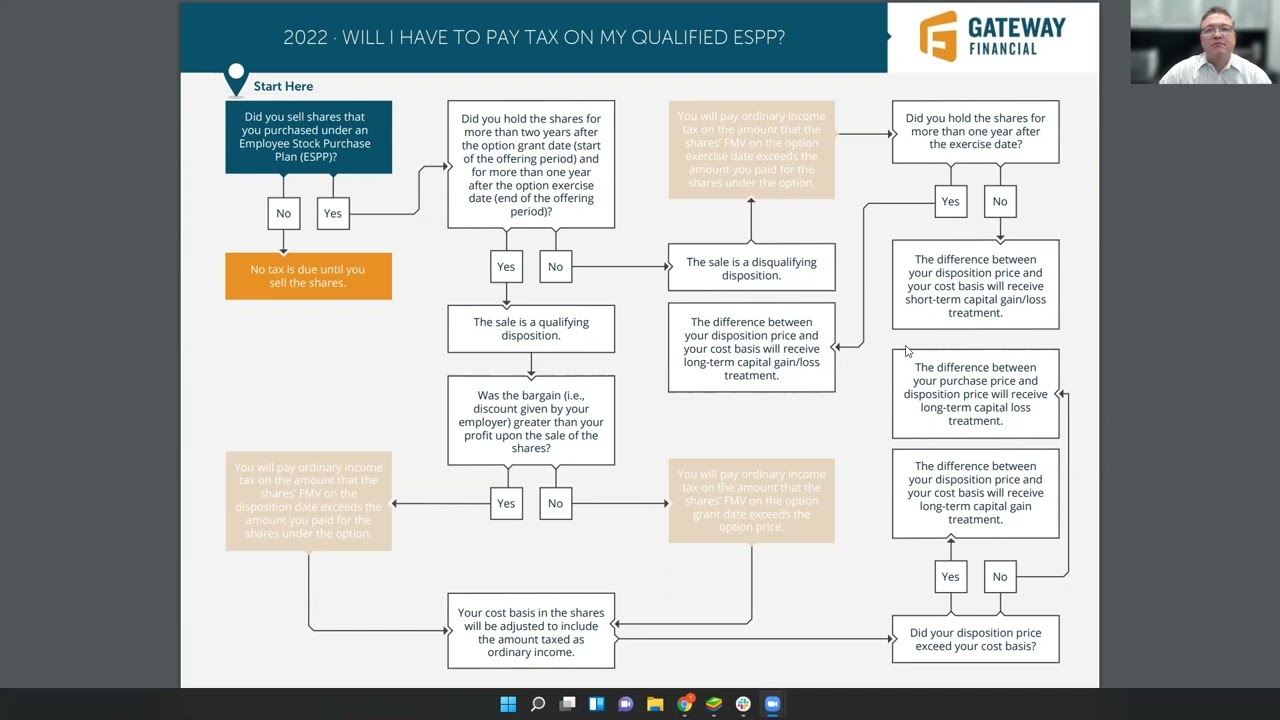

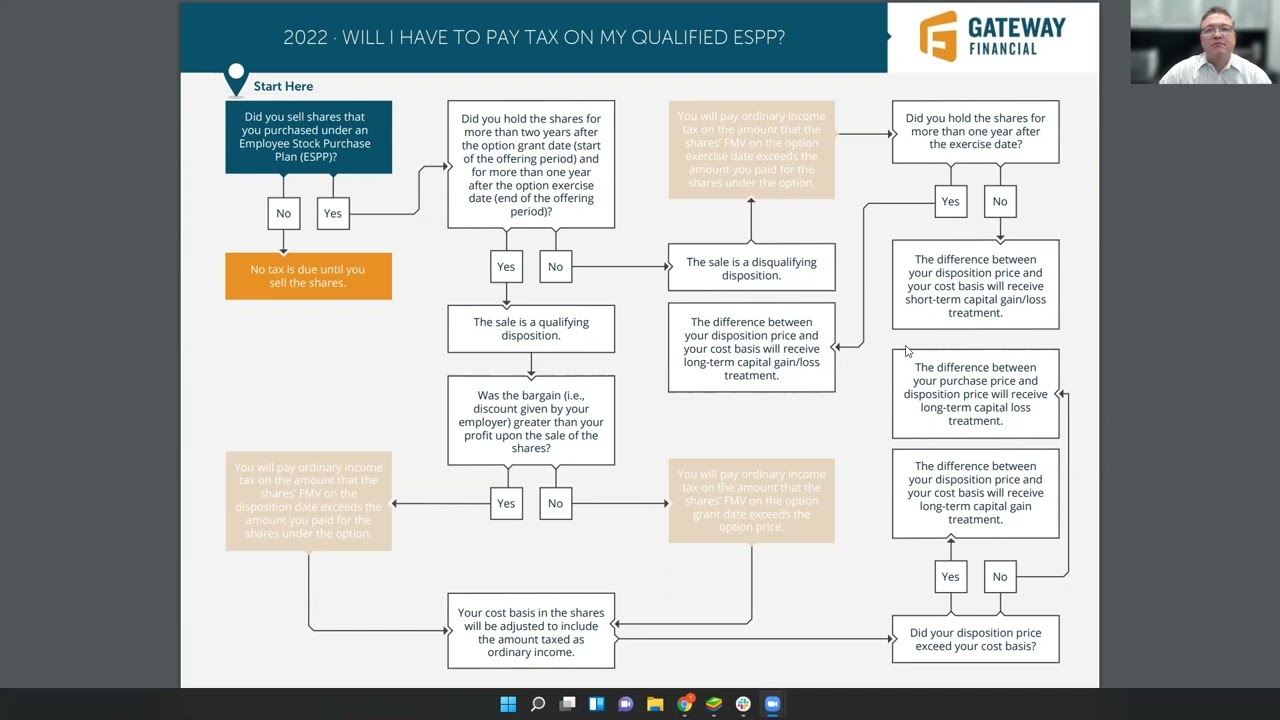

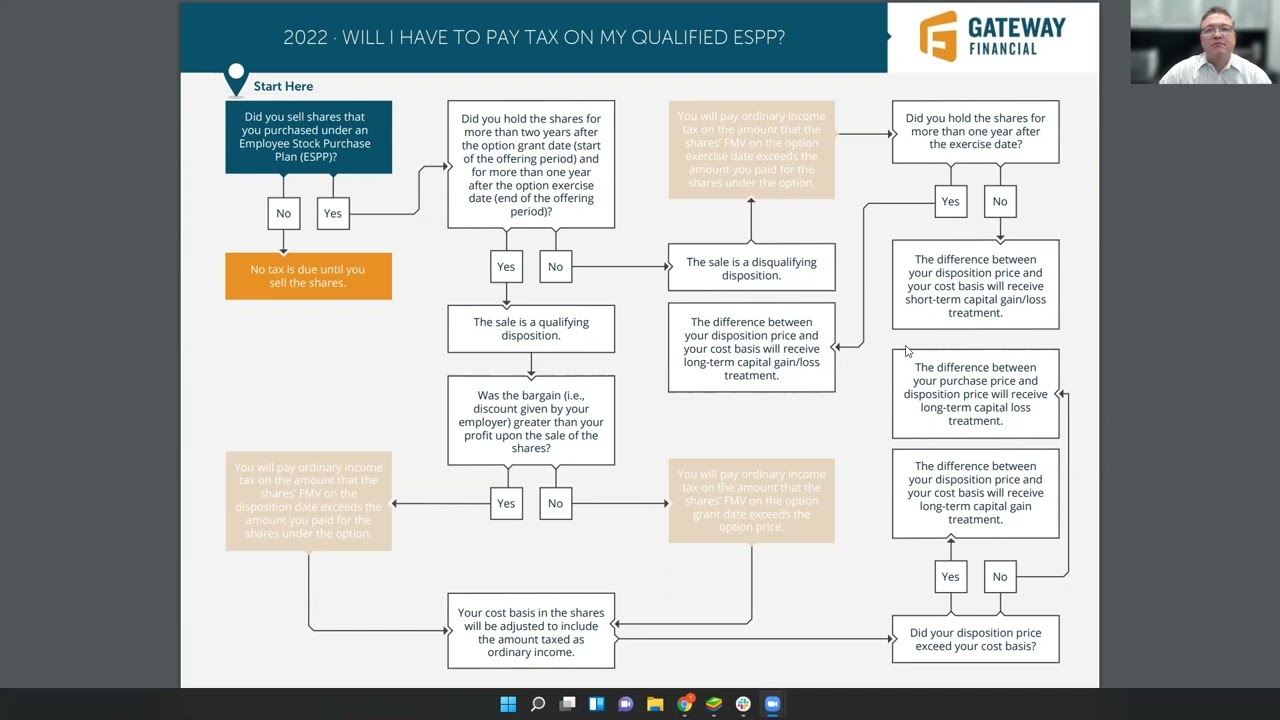

Will I have to pay tax on my Qualified Employee Stock Purchase Plan (ESPP)?

Employee Stock Purchase Plans can be an important benefit for our clients. These programs can allow the purchase of employer stock at a disc

Jan 19, 2022

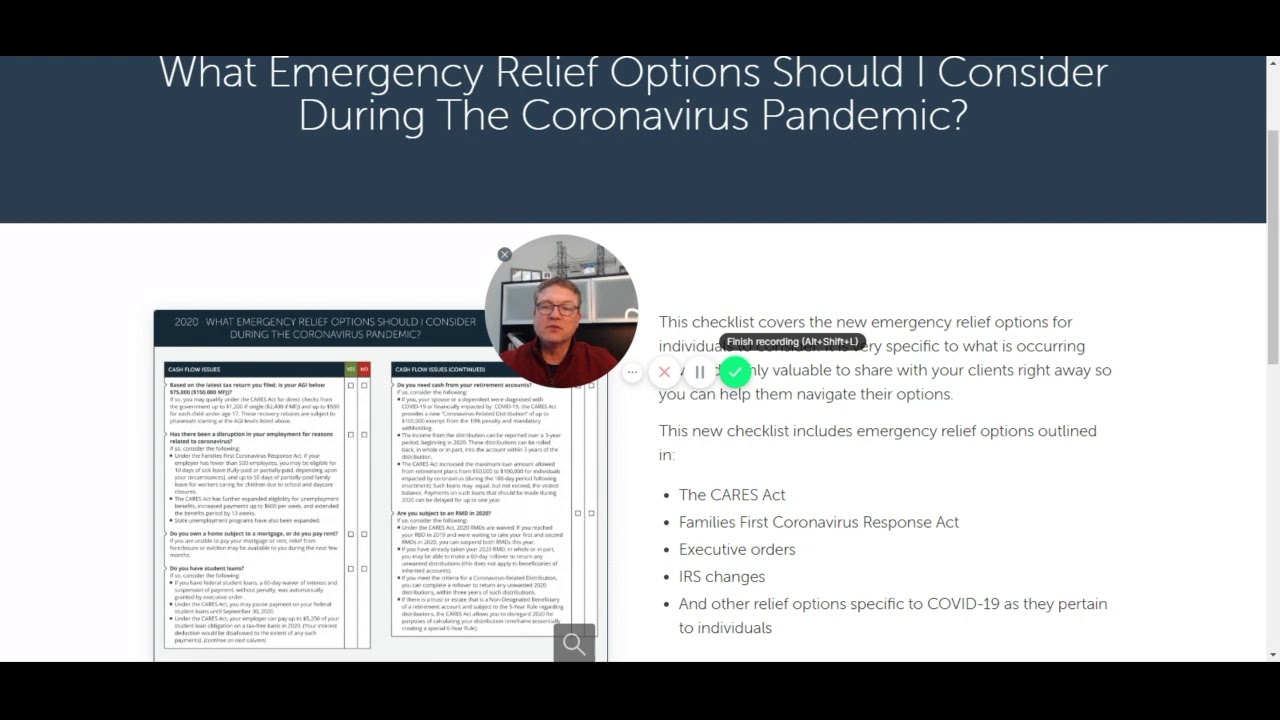

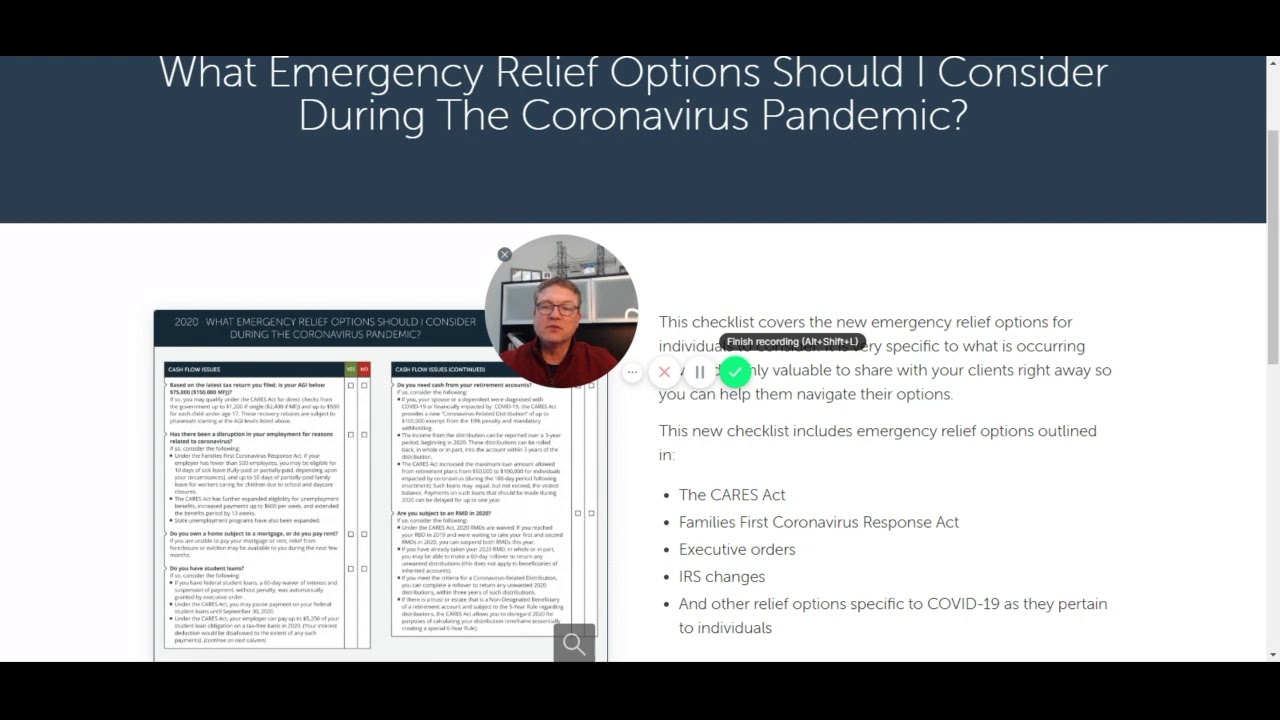

What Emergency Relief Options Should I Consider During The Coronavirus Pandemic?

What Emergency Relief Options Should I Consider During The Coronavirus Pandemic?

Apr 2, 2020

What issues should I consider during a recession or market correction?

What issues should I consider during a recession or market correction?

Apr 2, 2020

.png)